Texas does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid texas s complex probate process.

Revocable living trust vs will in texas.

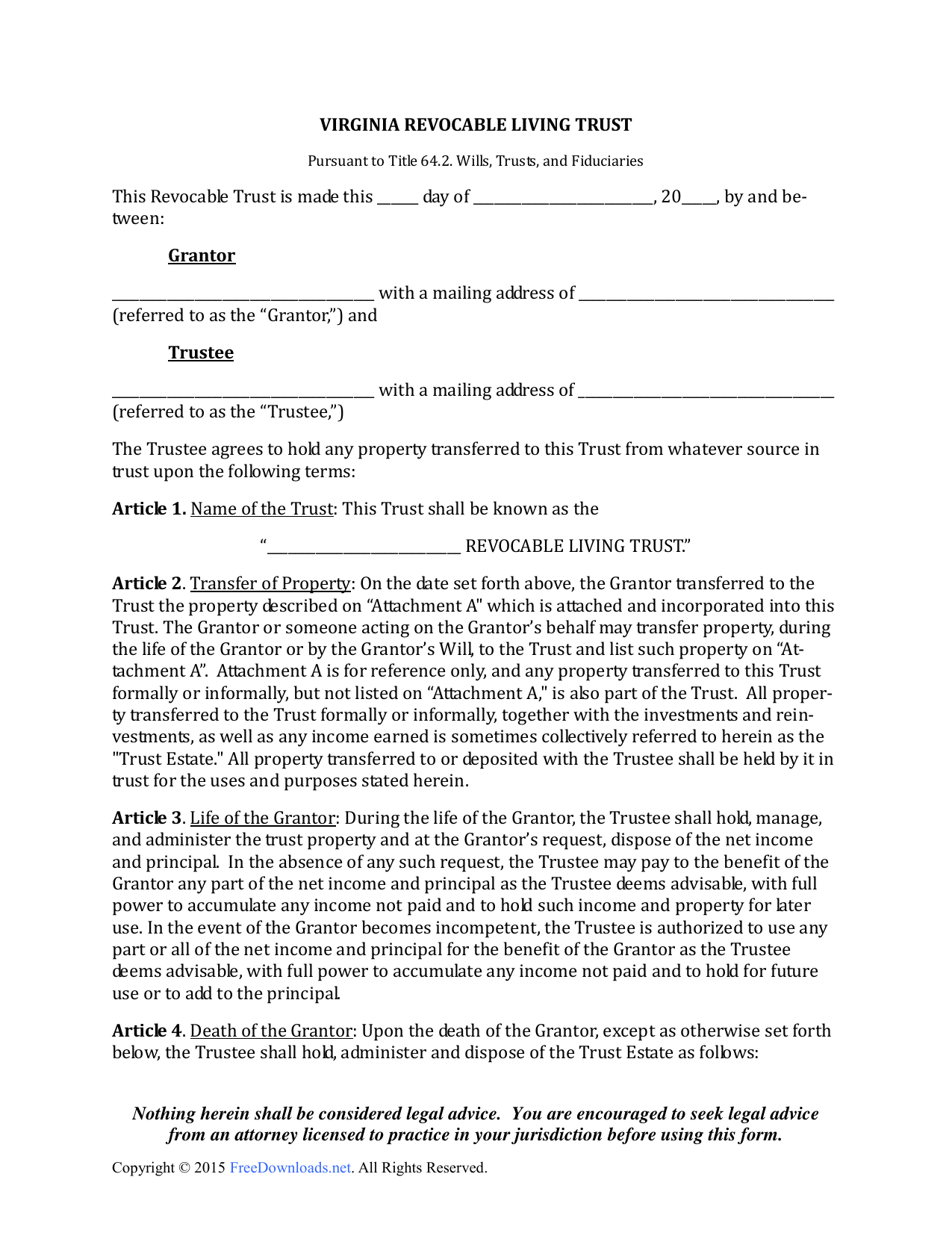

A revocable living trust also called an inter vivos trust offers a variety of benefits as an estate planning tool.

Both are regulated by state statute.

For residents of texas is there an advantage to setting up a living trust versus a will.

Title of all property is then transferred to the living trust.

Revocable living trusts are widely used in a number of states including california and florida but are not as common in texas.

A will rather than a living trust is the estate planning vehicle.

With a living trust you re paying everything up front.

A revocable living trust doesn t require probate because the trust owns the assets and the trust hasn t died.

The alternative is to have a revocable living trust own most of your assets and have the terms of the trust agreement determine how assets are distributed.

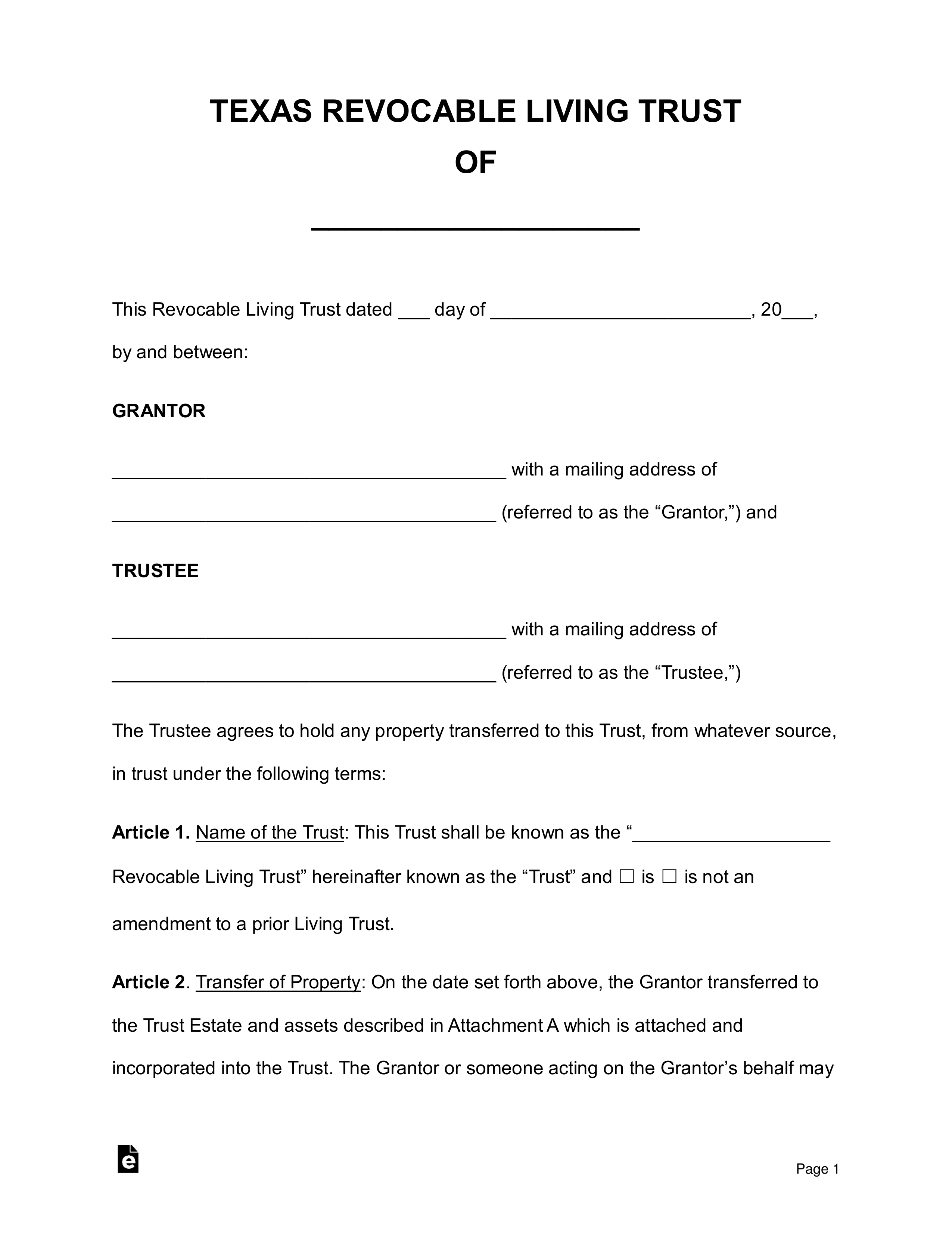

During the process of creating a living trust the grantor will transfer ownership of their property and assets into the trust.

A living trust is generally much more expensive than a will at least in the short term.

It s a private contract between you as the trustmaker or grantor and the trust entity.

Texas has a simplified probate process for small estates under 75 000.

Living trusts in texas a texas living trust is set up by the settlor the person who places the assets in trust.

However each has significant differences.

I was told there is no probate in texas and therefore a living will was not necessary.

In most cases the grantor serves as the trustee of his own revocable living trust managing the property placed within it during his lifetime.

With a will you re pushing off all the expensive of probate until after you re gone says gonzales.

The best choice for one person might not.