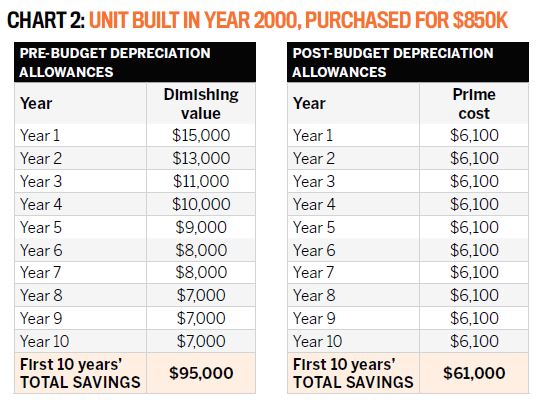

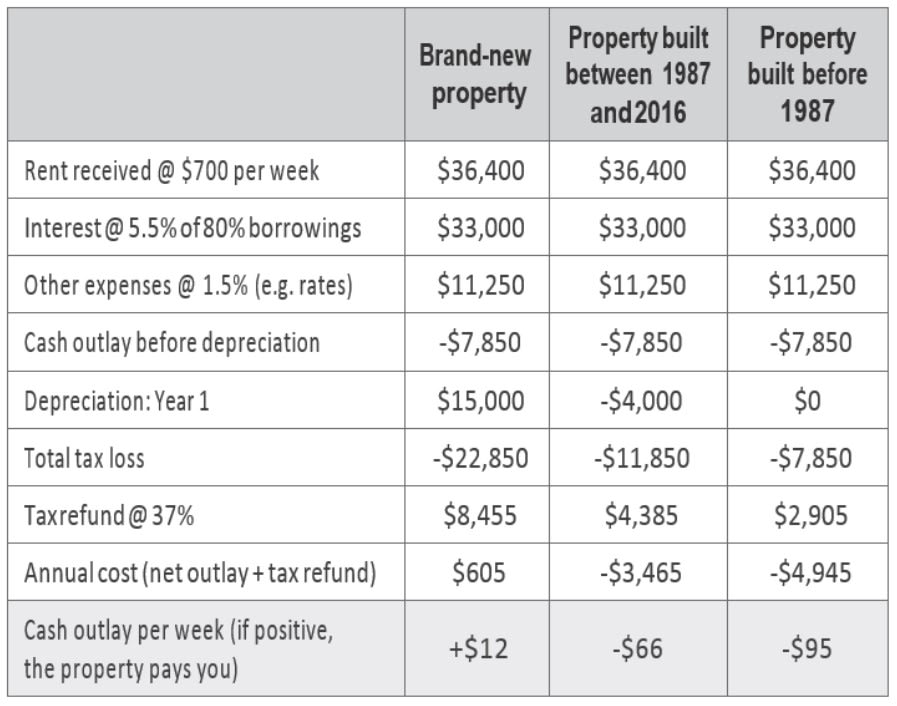

Depreciation can be a valuable tool if you invest in rental properties because it allows you to spread out the cost of buying the property over decades thereby reducing each year s tax bill.

Rental property carpet depreciation ato.

Depreciation is a capital expense.

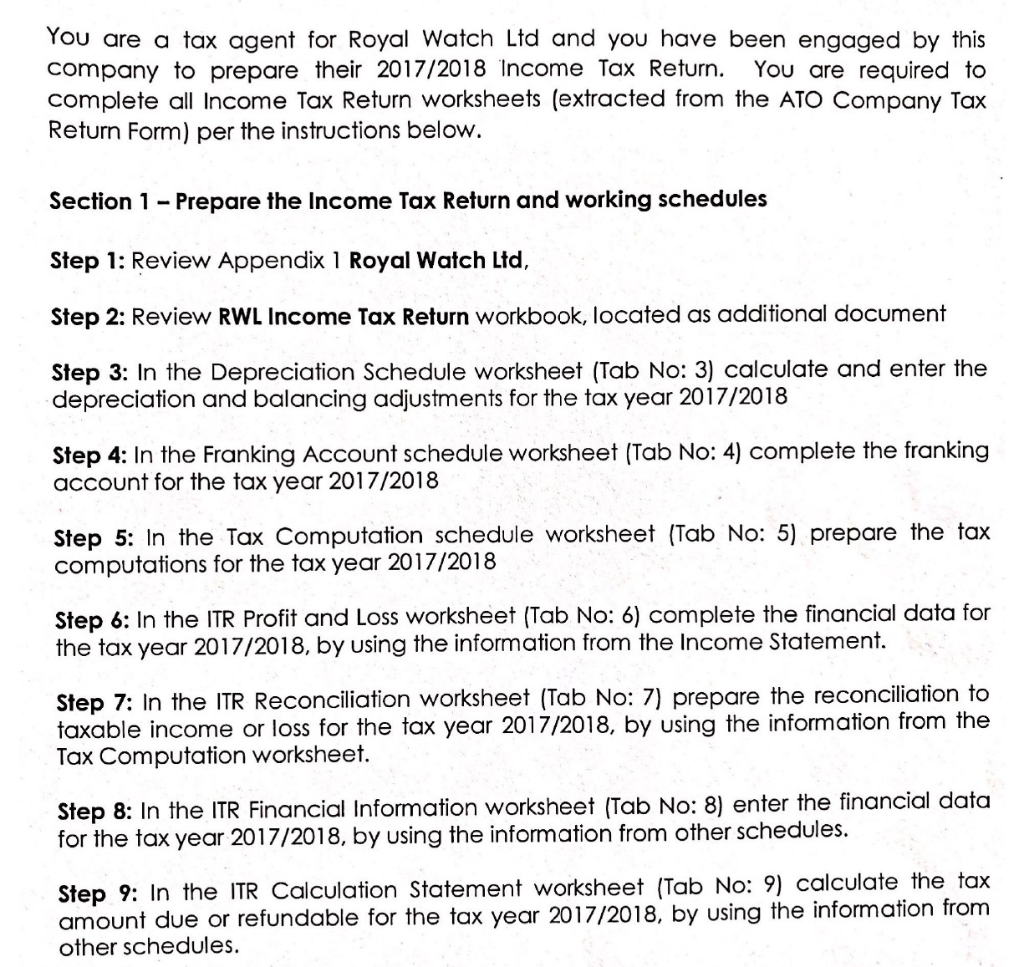

Cases family trust cases.

This is the report that states all your claimable depreciation for tax purposes.

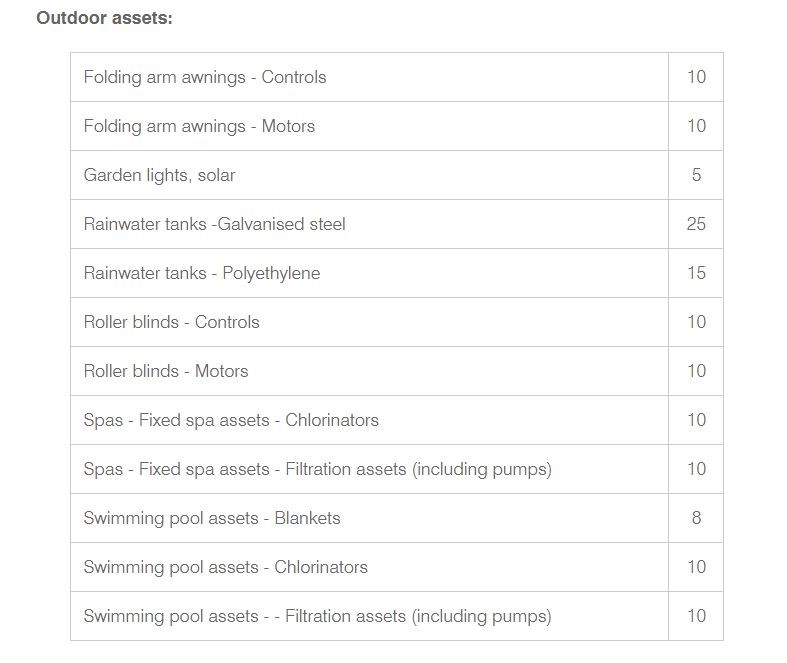

Floor carpet including.

Your rental property is positively geared if your deductible expenses are less than the income you earn from the property that is you make a profit from your.

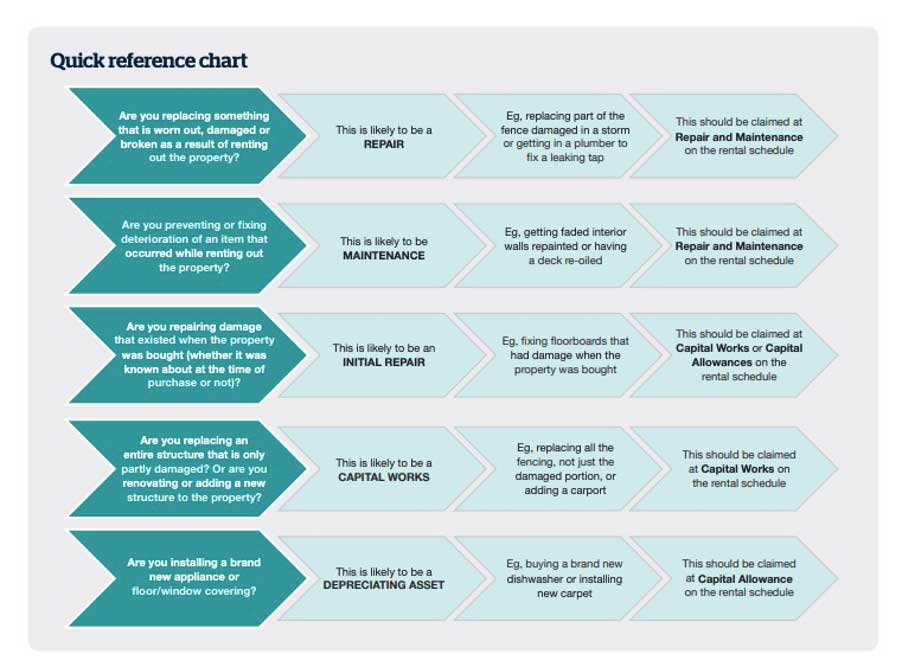

In addition to your operating expenses you can deduct from your rental income any expenses related to the property s upkeep.

Residential property operators 67110.

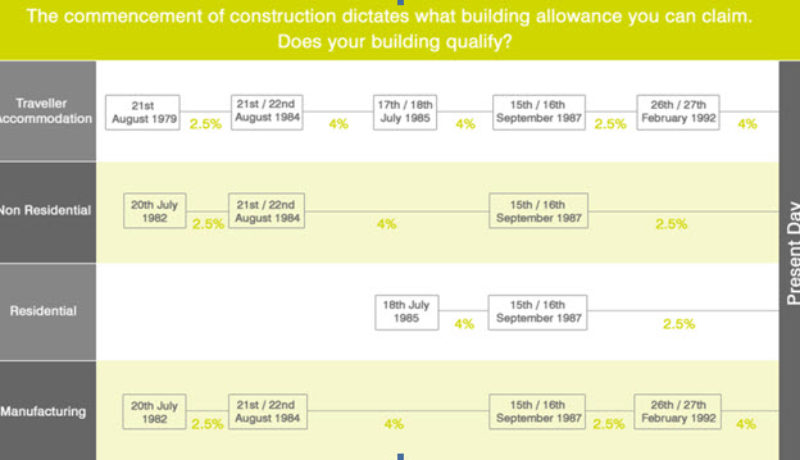

Ato depreciation rates 2020.

See placed in service under when does depreciation begin and end in chapter 2.

Rental properties non economic rental holiday home share of residence etc.

Since these floors are considered to be a part of your rental property they have the same useful life as your rental property.

Rental hiring and real estate services 66110 to 67200.

Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

Repairing after a rental disaster.

You can begin to depreciate rental property when it is ready and available for rent.

Taxation ruling it 2167 income tax.

It is important to note that in most cases the ato only allows you to backdate depreciation by 2 years.

Generally replacing a worn carpet qualifies as a deductible expense.

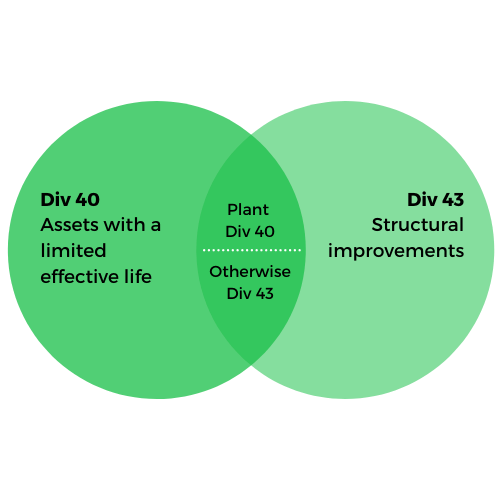

The amendments do not permit craig to deduct an amount under div 40 for the decline in value of the carpet the washing machine or the fridge for their use in generating assessable income from the use of his apartment as a rental property because all of these assets have been previously used.

As such the irs requires you to depreciate them over a 27 5 year.

Floor coverings removable without damage.

The carpet the washing machine and the fridge.

It is the mechanism for recovering your cost in an income producing property and must be taken over the expected life of the property.